Table of Contents

- The Best Investment For A Beginner, Vanguard S&P 500 ETF (NYSEARCA:VOO ...

- VOO Review: Is VOO a Good ETF to Invest In? - Thoughtful Finance

- VOO Stock Price and Chart — AMEX:VOO — TradingView

- VOO Stock Price and Chart — AMEX:VOO — TradingView

- VOO vs SCHD: Which ETF is Better? — The Market Hustle

- VOO Stock Fund Price and Chart — AMEX:VOO — TradingView

- VOO vs VTI: An Easy Way to Choose Between an S&P 500 and Total Stock ...

- Voo investment calculator - TerrinaJayke

- VOO vs. VOOG vs. VOOV: What's the Difference? - Four Pillar Freedom (2023)

- VOO Stock Price Today (plus 9 insightful charts) • ETFvest

Unlocking the Power of Index Investing: A Comprehensive Guide to the Vanguard S&P 500 ETF (VOO)

For investors seeking to diversify their portfolios and tap into the potential of the US stock market, the Vanguard S&P 500 ETF (VOO) has emerged as a popular choice. This exchange-traded fund (ETF) offers a low-cost and efficient way to gain exposure to the S&P 500 Index, which is widely regarded as a benchmark for the US stock market. In this article, we will delve into the world of VOO, exploring what it is, how it works, and why it has become a favorite among investors.

What is the Vanguard S&P 500 ETF (VOO)?

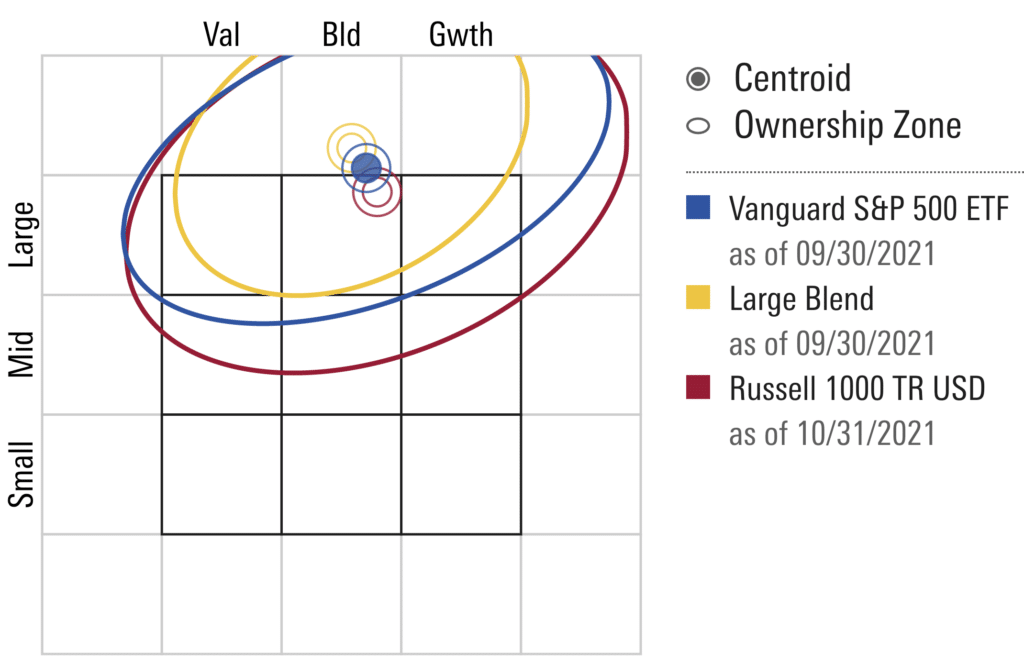

The Vanguard S&P 500 ETF (VOO) is an exchange-traded fund that tracks the performance of the S&P 500 Index, which comprises the 500 largest publicly traded companies in the US. By investing in VOO, you essentially own a small piece of the US stock market, providing broad diversification and potential long-term growth. The ETF is managed by Vanguard, a renowned investment management company known for its low-cost index funds and ETFs.

How Does VOO Work?

VOO is designed to replicate the performance of the S&P 500 Index by holding a representative sample of the same stocks in the index. The ETF uses a passive management approach, which means it does not attempt to beat the market but rather aims to match its performance. This approach helps keep costs low, as there is no need for active management or frequent buying and selling of securities.

Here's a breakdown of how VOO works:

- Index Tracking: VOO tracks the S&P 500 Index, which is calculated and maintained by S&P Dow Jones Indices.

- Stock Holdings: The ETF holds a representative sample of the same stocks in the S&P 500 Index, with the same weightings.

- Passive Management: VOO uses a passive management approach, which means it does not try to beat the market but rather matches its performance.

- Low Costs: The ETF has a low expense ratio, making it an attractive option for cost-conscious investors.

Benefits of Investing in VOO

Investing in VOO offers several benefits, including:

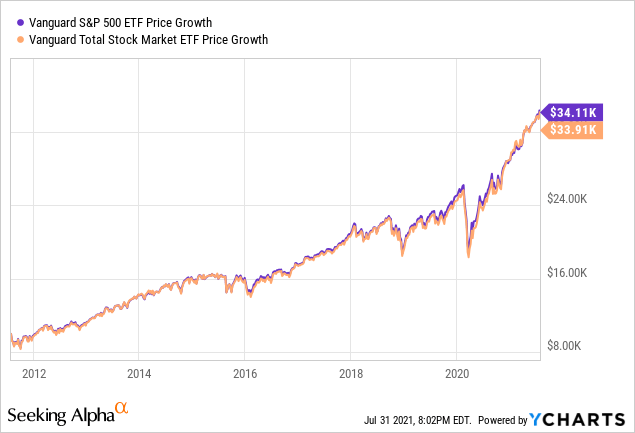

- Diversification: By investing in VOO, you gain exposure to 500 of the largest US companies, providing broad diversification and reducing risk.

- Low Costs: The ETF has a low expense ratio, making it an attractive option for cost-conscious investors.

- Convenience: VOO is an exchange-traded fund, which means you can buy and sell shares throughout the trading day, providing flexibility and liquidity.

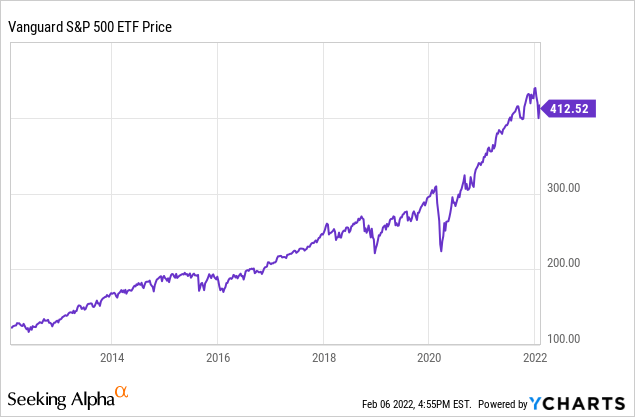

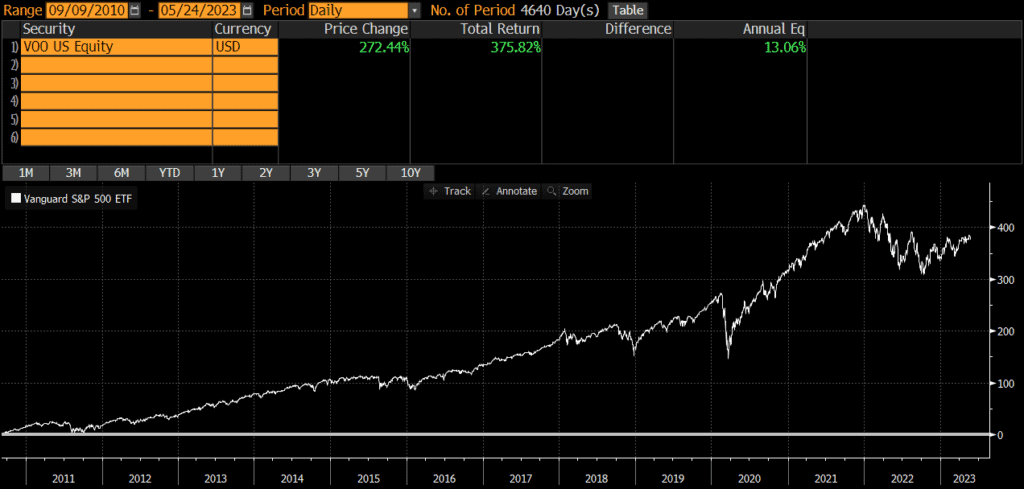

- Long-term Growth: The S&P 500 Index has a long history of providing strong long-term returns, making VOO a potential option for investors seeking growth over the long haul.

In conclusion, the Vanguard S&P 500 ETF (VOO) is a popular and efficient way to gain exposure to the US stock market. With its low costs, broad diversification, and potential for long-term growth, VOO has become a favorite among investors. Whether you're a seasoned investor or just starting out, VOO is definitely worth considering as part of a well-diversified investment portfolio. By understanding how VOO works and the benefits it offers, you can make informed investment decisions and unlock the power of index investing.